A new independent survey by research firm Ovum on behalf of global analytic software firm FICO has found that most banks plan to integrate their fraud and financial crime compliance systems and activities in response to new criminal threats and punishing fines.

Ovum surveyed over 100 retail banks on their priorities, challenges, and plans for financial crime. Respondents came from the UK, the US, Canada, South Africa, the Nordics, Germany and Austria.

Since the financial crisis, regulatory fines for the global banking industry for compliance breaches related to anti-money laundering or sanctions failures now total more than $28-billion. Some single fines have been as high as $8,9-billion. However, this regulatory “stick” is only one driver for banks to tackle financial crime — banks also wish to protect their customers and themselves.

“Banks are asking a fundamental question: Is the current approach to tackling financial crime sustainable or should they seek a more integrated approach between fraud and anti-money laundering (AML) compliance?” says Matt Cox, who oversees fraud, compliance and cybersecurity solutions for FICO.

FICO’s survey found major differences between approaches in South Africa and the nine other countries studied.

Top 3 pain points in meeting financial crime compliance objectives

| Priorities | South Africa | Rest of World |

| 1 | Ensuring detection rates are high – 62% | Ensuring detection rates are high – 38% |

| 2 | Speed in responding to new financial crime threats – 46% | Managing high workload volumes due to defensive approach (e.g. SAR filings) – 37% |

| 3 | High levels of false positives – 46% | High levels of false positives – 36% |

“South Africa is very focused on preventing financial crime,” says Cox. “Changing financial crime patterns require systems that can ‘think’ in real time, and connect fraudulent activity with money laundering.”

Main technology challenges for anti-financial crime functions

| Priorities | South Africa | Rest of World |

| 1 | Cost of technology systems – 54% | Performance of technology platforms – 48% |

| 2 | Performance of technology platforms – 46% | Use of multiple systems across operational processes – 43% |

| 3 | Ability to support management reporting – 46% | Cost of technology systems – 35% |

Compared to other regions, the cost of systems is more of a challenge for RSA banks. Performance of systems ranked high worldwide.

Current highest levels of integration between fraud and financial crime compliance functions

| Top Areas | South Africa | Rest of World |

| 1 | Detection systems – 38% very integrated | Data – 30% very integrated |

| 2 | Financial crime related employees – 31% very integrated | Controls – 25% very integrated |

| 3 | Investigation systems – 23% very integrated | Investigation systems – 24% very integrated |

Although South Africa recorded high levels of integration in their detection systems, financial crime related employees and investigation, they still fell greatly short in data integration compared to the other regions. Only 8% of RSA banking respondents said their data is very integrated, while for the other regions the figure is 30%.

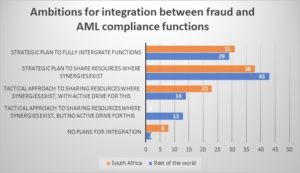

Given the focus on stopping financial crime, it comes as no surprise that 31% of South African banks reported having strategic plans to fully integrate fraud and AML functions. This is slightly ahead of the rest of the world, but much less than the UK, where nearly half of their banks reported a strategic plan that aims to fully integrate functions.