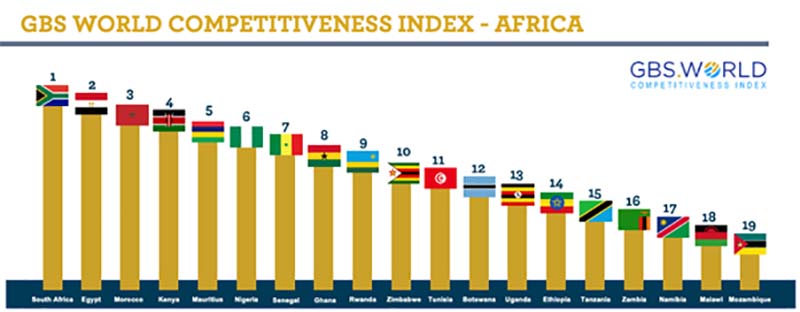

African countries rank positively in the GBS World Competitiveness Index, with South Africa and Egypt scoring as High Performers in five categories.

More than 140 global business services (GBS) buyers and enterprise executives of organisations that outsource and offshore to Africa were asked to rank and rate each African country (all 54 countries) for the index.

The index was launched late-August 2021 and formed part of a broader global vertical industry demand survey conducted by Knowledge Executive on behalf of the GBS.World marketplace in Australia, Canada, France, Germany, the UK and the US. The top 10 African countries were ranked according to their final scores and placed within three categories: High Performer, Proficient and Capable.

South Africa leads the overall rankings for contact centre voice service delivery, with a score of 6.60. Egypt (5.93) and Morocco (4) are ranked second and third, respectively. Tunisia is ranked last, with a score of 1.50. Nigeria (2.40) and Zimbabwe (2.80) have the third and second-lowest ratings, respectively.

Enterprise executives were also asked to score and rank offshore African locations where they currently outsource or co-source back office processes. South Africa was noted as a leading destination for back office processing service delivery, scoring 5.24 out of 8 followed by Egypt which scored 4.95 and Nigeria with 4.86.

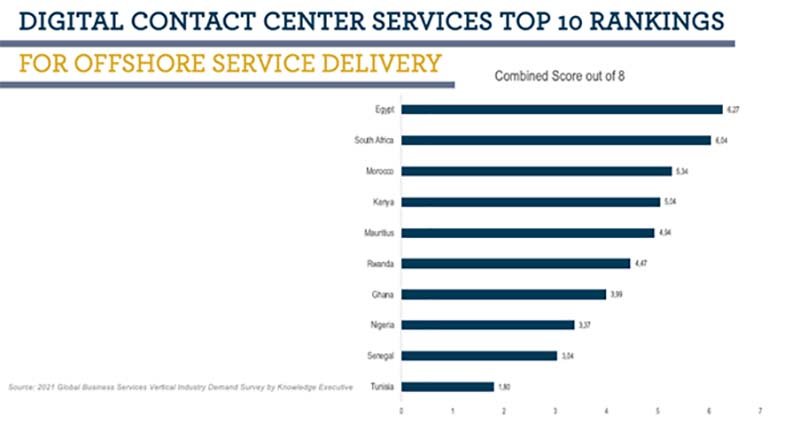

Well known for its digital and IT-enabling services Egypt (6.27) took first place for digital contact center services, followed closely by South Africa (6.04), Morocco (5.34) and Kenya (5.04).

Egypt also scored the highest for the delivery of data management services, with a score of 6,03. South Africa was ranked second, with a score of 5.87, followed by Mauritius, with a score of 5.43.

South Africa was ranked first in the customer administration service delivery rating, with a score of 6.10 out of 8. Egypt (5.71) was ranked a close second, followed by Morocco (5.24).

Additional analyses were conducted on each country’s talent pools, skills development initiatives, youth populations, ICT infrastructure, transport systems, multilingual capabilities, labour costs, specialist business process services, customer experience (CX) capabilities, economic and political stability. Tallied results established the final competitiveness scores across the top 19 African GBS locations.

The African business process outsourcing (BPO) and broader GBS sector is poised for exponential growth as the domestic and international markets of various countries expand and flex their outsourcing and offshoring proficiencies.

Research conducted by Knowledge Executive found that the total African GBS offshoring market alone is expected to reach $11,7-billion by 2023 from $8,3-billion in 2021.

Collectively, the domestic and international BPO/GBS market on the continent generates $16,1-billion in revenue and is expected to rise to $21,4-billion by 2023.