Budget 2023 announced incentives worth R9-billion for businesses and households to invest in renewable energy, including solar power generation. South Africa has one of the best solar generation profiles in the world and solar power can go a long way to help reduce electricity load-shedding.

Businesses were previously allowed to deduct the costs of qualifying renewable energy investments over a three-year period. Now, companies will until February 2025 be able to claim a 125% deduction in the first year for all new renewable energy projects brought into use from next month, including wind, concentrated and photovoltaic (PV) solar, hydropower and biomass. The National Treasury has set aside R5-billion for this

Private households will, from next month, be able to claim a 25% rebate on the cost of solar photovoltaic (PV) panels. The benefit of up to R15,000 per individual is available on solar panels purchased and installed at a private residence between March 2023 and February 2024. However, the rebate is only available for solar PV panels (mostly imported) and not on inverters or batteries (some of which are manufactured locally).

PwC South Africa chief economist and ESG Africa Lead, Lullu Krugel, says: “This is likely aimed at encouraging solar power generation for feeding into the national grid instead of being exclusively used for household consumption via battery storage.”

Impact of load-shedding on the economy

The last time changes were made to green energy investment incentives was in 2016. The magnitude of current investment in renewables could not have been anticipated at that time considering the ramp-up in load-shedding from 2017 to the present. Indeed, in our November 2022 South Africa Economic Outlook (‘Sustainable options to plug the energy deficit’) we warned that the country is experiencing an energy shortage that is having a profound impact on its economy.

PwC South Africa senior economist, Christie Viljoen, says: “South Africa’s power challenges are severely affecting economic growth and jobs at a time when the country urgently needs to recover from the aftereffects of the Covid-19 crisis to retain its competitiveness and attractiveness. Indeed, load-shedding is the number one brake on economic and employment growth.

As reported in its January 2023 South Africa Economic Outlook (‘Forecast scenarios for key macro data in 2023’), PwC estimates that power cuts reduced potential real GDP growth by five percentage points in 2022. This cost the country around 600 000 in potential jobs.

The channels of negative impact on the economy are diverse, including: weaker consumer confidence weighing on retail spending; lower business confidence impacting investment decisions; and tainted international perceptions limiting foreign investment. Looking beyond GDP, society also faced increased crime risk due to off-line security systems, longer journeys linked to delayed transport, and unreliable communication from slower mobile telecommunication services, amongst other issues.

To remedy the load-shedding crisis, the National Energy Crisis Committee (NECOM) announced in January their aim to recover and add 8 800 MW of capacity to South Africa’s electricity supply during the course of 2023, including some solar generation. In the following table, PwC provides a perspective on the difficulty to roll out these initiatives given the current circumstances and information available in the specified period (2023 calendar year) and the potential impact of each intervention on electricity security.

Planned NECOM interventions for 2023

| Intervention | Difficulty of achieving outcome in 2023 | Impact of intervention on electricity security | Comment |

| Bring Kusile units 1, 2 and 3 back online, plus achieve commercial operation for Unit 5 (2,880MW) | Difficult | High | Will assist electricity baseload and can reduce at least two stages of load shedding. Infrastructure already exists though the timeline to repair is up to 24 months. |

| Additional imports from neighbours in the Southern African Power Pool (SAPP) (1,325MW) | Difficult | Low | Infrastructure already exists. The implementation timeline is very short and contractual agreements of the day-ahead market (DAM) already exist. However, SA currently exports more energy (13,298 GWh in 2022) to SAPP than it imports (8,500 GWh), indicating limited generating capacity elsewhere in SAPP to support SA’s import needs. Small capital cost. |

| An emergency generation programme and a standard offer from Eskom to buy excess capacity from commercial/industrial customers (1,000MW) | Difficult | Medium | May require investment in infrastructure, Timeline to implement is up to 24 months. While this does not provide baseload support, it will still provide energy to the grid. Large capital cost. |

| Utility-scale private embedded generation projects (<1.600MW) | Difficult | Medium | |

| Using feed-in tariffs to unlock supply from commercial and household rooftop solar (850MW) | Highly possible | Medium | Infrastructure already exists. The timeline to implement is two to six months depending on regulatory requirements. While this does not provide baseload support, it will still provide energy to the grid. Small capital cost. |

| Ramp up demand-side and energy efficiency programmes to cut demand (250MW) | Highly possible | High | Infrastructure already exists. The implementation timeline is very short. Will reduce peak demand and can be extended to other customer segments. Small capital cost. |

| Complete first phase of Eskom’s battery energy storage system (200MW) | Difficult | Medium | Implementation timeline is between 18 and 24 months and can be available in a short period of time. Will provide flexibility to the grid. Large capital cost. |

| Contract surplus supply from existing renewable producers (70MW) | Highly possible | Low | Infrastructure already exists. The implementation timeline is three to 12 months. 10MW of renewable energy is equal to 3.3 MW of actual real power. Small capital cost. |

Source: NECOM, PwC analysis

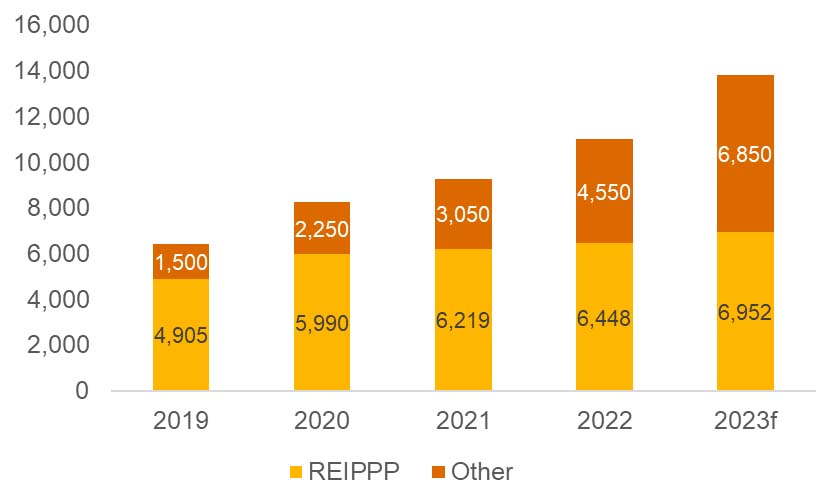

Off-grid solar capacity could reach 6 850 MW in 2023

Solar power will play a role in several of NECOM’s endeavours. Local businesses and households are already exploiting renewable energy options to improve their energy security and will likely increase this with the newly announced incentives. To be fair, rooftop solar is not as efficient as grid-scale solar, but because generation is established close to the area of consumption, the required investment in transmission and distribution infrastructure is limited.

Research by Moneyweb found that South Africa had about 1 500 MW of private sector solar installations in 2019 outside of the Renewable Independent Power Producer Programme (REIPPP). The increased prevalence of load-shedding over the following years resulted in non-REIPPP installations increasing to 4 550 MW by the end of 2022, with the South African Photovoltaic Industry Association (SAPVIA) saying earlier this month it is expecting another 2 300 MW to be added in 2023, to bring the total capacity to 6 850 MW. That will be almost as large as REIPPP solar capacity.

Installed solar generating capacity (MW)

Source: PwC calculations based on data from South African Photovoltaic Industry Association (SAPVIA), Fitch Solutions, Moneyweb

Most of the non-REIPPP installations are for self-consumption, either to reduce cost of supply and/or reduce the impact of load shedding. Restrictions on the amount that these systems may feed back into the grid and the cost of smart metres to do so have been significant hurdles to feeding excess generated electricity back into the grid.

Getting the regulations and incentives right

PwC’s recent report ‘Municipal energy: The cities’ role in managing the energy supply challenges’ outlines what can be done at, for example, the local government level to shore up the country’s energy shortfall. With the right regulations in place, the ideal scenario would be for municipalities to purchase electricity from different suppliers in a competitive market at competitive prices, allowing resale at a surplus and transmission to households and businesses at a lower cost to consumers. These suppliers include, for example, households and businesses with installed surplus solar generation capacity.

One of the benefits that can potentially unlock more solar installation in commercial and residential buildings is the concept of net billing. This would compensate prosumers (who both produce and consume energy) based on the actual market value of electricity. This is achieved by balancing what the prosumers consume to keep their lights on with the surplus that they inject into the grid.

Alternative mechanisms like a feed-in-tariff (FiT) works on a similar business model but with the provision that excess energy injected into the grid is compensated at a predetermined tariff. This is similar to what the City of Cape Town (CoCT) plans to implement from June 2023. The advantage of these tariff schemes is that the predetermined tariff is normally higher than the retail electricity tariff which is used to incentivise prosumers to install distributed renewable energy sources.

Work is underway to develop a net billing framework for municipalities to enable customers to feed electricity from rooftop solar installations onto the grid. However, the ability to adopt FiT mechanisms greatly depends on the financial ability of the specific municipality to afford the implementation of a FiT. Greater support is needed from the national government to enable municipalities to afford the introduction of municipal feed-in mechanisms. Such mechanisms must be supported by clear and transparent municipal provisions outlining the processes and rules to support the rollout of municipal feed-in-tariffs.

In addition to the introduction of feed-in-mechanisms, there is a need to create an enabling regulatory environment for the deployment of renewable energy at a larger scale. The key regulatory measures are promulgation of the Electricity Regulation Amendment Bill and clarity on municipal energy procurement.

Looking beyond the national state of disaster

During his State of the Nation Address (SONA) 2023, President Cyril Ramaphosa declared a national state of disaster to respond to the electricity crisis. The state of disaster enables the government to accelerate the roll-out of much needed energy projects by leveraging certain regulatory mechanisms.

Given this declaration, greater clarity is needed on how municipalities can deviate from stringent procurement policies in order to expedite the uptake of small-scale renewables like solar energy whilst ensuring transparent and legal procurement takes place. At the same time, South Africa needs to relook its long-term energy mix.

“Considering the holistic energy landscape, expanding South Africa’s solar footprint is only part of a long list of endeavours that are needed to improve the country’s energy security,” Krugel says. “Collaboration is needed between different market players to enable us to address the energy access challenges and to consider the role that various energy sources could and should play in the solution, including getting a clear understanding of the decarbonisation roadmap that the country should follow.”

When considering that privately funded solar power installations – even with the newly announced incentives – is limited by affordability to large companies and affluent households, the vast majority of South African households and businesses will not achieve energy security solutions through this channel.

Additional measures are needed to address the electricity crisis and ensure security of supply. Large scale renewable energy deployment supported by other alternative energy options (such as gas and low-carbon fuels) will be necessary to provide reliable baseload energy for the country. Given the variability of renewable energy resources, large scale battery energy storage technologies would also be needed to mitigate intermittencies associated with wind and solar.

New deployment mechanisms need to be developed and implemented in order to drive and intensify the scale and timing of renewable and alternative energy initiatives. One such type of mechanism is an energy aggregation model, where power is pooled by both private and municipal entities and distributed by leveraging regulatory possibilities, such as the proposed establishment of a competitive energy multi-market.

The Eskom debt plan

Finally, a key part of the long-term energy mix question is Eskom’s ability to remain solvent and afford new investment: the power utility currently has around R423-billion in debt of which R350-billion is guaranteed by the state. Budget 2023 plans to provide Eskom with R254-billion over the next three years towards paying down capital (R168-billion) and interest (R86-billion), subject to strict conditions. This will be funded by R66-billion from the main budget and R118-billion in additional borrowing by the sovereign over the next three years, which will result in public debt rising to (and peaking at) 73,6% of GDP in 2025/2026.

“While the impact on overall debt is therefore small, it sends an important message to funders of SOEs about the stability of loan funding and it could play a stabilising role if that is considered,” Viljoen says. “The funding is conditional on Eskom implementing operational recommendations from an independent assessment of its coal plants due to be finalised in June 2023.”