The latest survey from Oxford Economics on business risk perceptions suggests banking system strains and tightened credit supply now pose the greatest threats to the global economy.

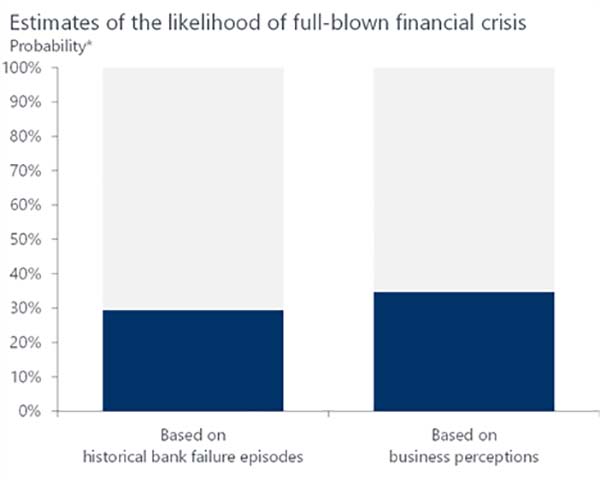

Respondents perceive a one-in-three chance of a full-blown financial crisis comparable to the global financial crisis.

While more businesses are citing a rebound in consumer spending as the key potential upside, respondents have become less positive about near-term global prospects. Businesses have cut growth expectations for 2023 and 2024 and see economic risks as weighted to the downside.

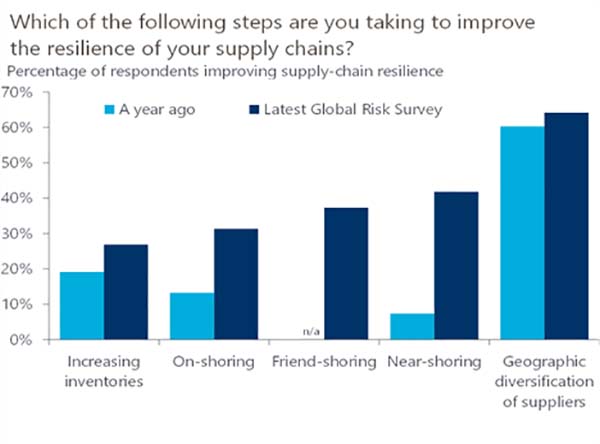

The latest survey highlights a rise in the proportion of businesses taking steps to improve supply-chain resilience. Of the 60% of respondents implementing such measures, more than a third report that they are pursuing “friend-shoring” and are rerouting supply chains to allied countries.

The survey was completed by 143 businesses from April 20-28.

The Q2 2023 Global Risk Survey was conducted amid further mixed news for the global economy. While the world economy has proven resilient, banking system problems have persisted since early March and have raised concerns over the potential for a severe crisis.

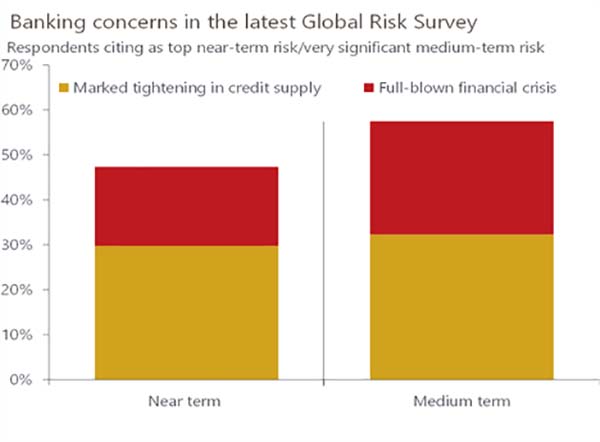

Against this backdrop, businesses have downgraded their expectations for growth this year and next. They also view the risks to global growth as increasingly weighted to the downside. The banking sector is now the main focus of concern. Nearly half of respondents view either a marked tightening in credit supply or a full-blown financial crisis as the top risk in the near term, while more than half cite these risks as very significant in the medium term (Chart 1).

Oxford Economics Global Risk Surveys canvas the views of Oxford Economics’ clients, including some of the world’s largest companies. Based on our analysis of the Q1 2020 survey, the participating companies collectively employ around 6-million people and have a total turnover of around $2-trillion.

Chart 1: Businesses now view the risk of a credit crunch as the key threat to the global economy

Source: Oxford Economics

Near-term growth outlook

Weaker sentiment

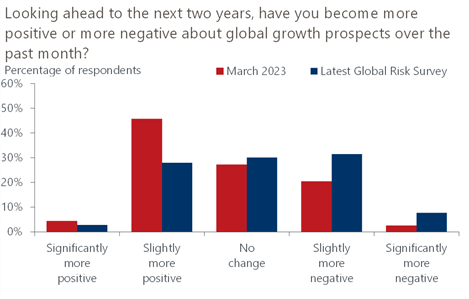

The Q2 Global Risk Survey suggests that business sentiment has worsened since early March. This follows an improvement in sentiment earlier in the year.

The deterioration is relatively contained, however. Around two-fifths of respondents have become more negative about near-term global prospects over the past month, accompanied by an increase in the proportion of those significantly more negative. But a significant minority (almost a third) report that they have become more positive (Chart 2).

Chart 2: Business sentiment has worsened

Source: Oxford Economics

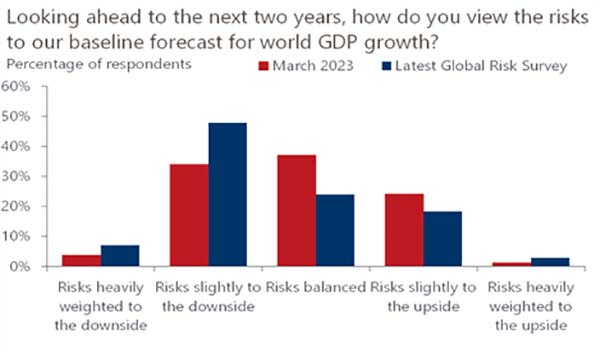

Risks increasingly to the downside

The balance of risks appears to have shifted significantly. For the first time since October 2022, a majority of businesses (55%) see risks as weighted to the downside. This month also saw an increase in the proportion of respondents perceiving risks to be heavily weighted to the downside (Chart 3).

Chart 3: Downside risks are seen to have increased

Source: Oxford Economics

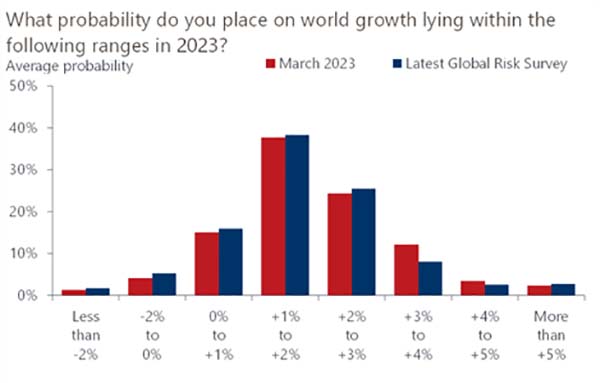

Weaker growth expected in 2023 and 2024

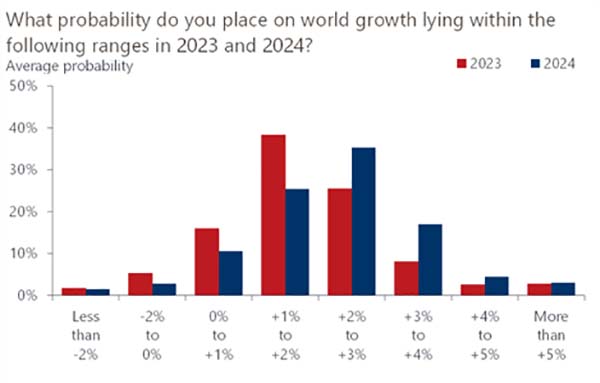

Businesses have lowered their growth expectations for this year (Chart 4). The mean expectation for world GDP growth in 2023 is 1.8%, down 0.1ppt from early March and 0.2ppts below our latest baseline forecast.

Chart 4: Businesses are less optimistic about growth this year

Source: Oxford Economics

Businesses reduced 2024 growth expectations more significantly. The mean expectation stands at 2.2%, 0.3ppts lower than in the previous survey and a little lower than in our baseline forecast. Respondents still anticipate faster global growth next year than this year (Chart 5).

Chart 5: Businesses still expect faster growth in 2024 than this year

Source: Oxford Economics Global Risk Survey

Near-term inflation outlook – Higher inflation expected for 2023

Businesses continue to expect elevated inflation in 2023 and have revised up their expectations further. Respondents’ mean expectation for world consumer price inflation stands at 5.4% in 2023 (Chart 6), up 0.3ppts on the previous survey.

Chart 6: Businesses expect higher inflation in 2023

Source: Oxford Economics

Higher inflation over the medium term

The rise in near-term inflation expectations has been accompanied by a rise in expectations for inflation further ahead. Businesses’ mean expectation is for world inflation of 3.4% over the medium term, 0.2ppts higher than three months ago (Chart 7) and some 0.6ppts above our baseline forecast. Respondents judge there to be a 1-in-4 chance of 4%+ world inflation over the medium term.

Chart 7: Medium-term inflation expectations have risen

Source: Oxford Economics

Key risks

Credit crunch fears dominate in the near term

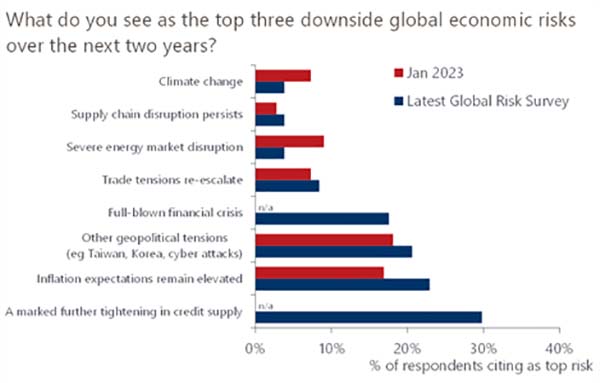

The latest survey highlights business concerns over the potential fallout from ongoing banking system strains. A marked further tightening in credit supply is now seen as the top downside risk to the global economy in the near term, cited by 30% of respondents (Chart 8).

In addition, 18% of respondents perceive that a full-blown financial crisis is the top threat over the next two years.

Businesses continue to highlight other concerns that were prominent in January’s quarterly survey. Both geopolitical tensions and the risk of inflation expectations remaining elevated are cited by around a fifth of respondents, even more than in the previous survey.

Chart 8: Banking-related risks are the dominant near-term concerns

Source: Oxford Economics

Credit crunch is a prominent medium-term risk

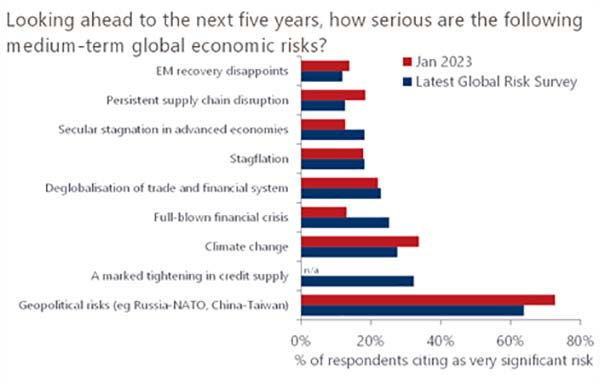

As last quarter, geopolitical concerns are the most cited global economic risk in the medium term. More than three-fifths of respondents view geopolitical risks – for example, related to Russia-NATO, China-Taiwan – as a very significant risk to the global economy over the next five years.

Almost as many businesses cite banking system-related risks, however. Around a third of respondents now see a marked tightening in credit supply as very significant, while a quarter cite a full-blown financial crisis (Chart 9).

Chart 9: A majority of businesses cite geopolitical and banking risks as very significant in the medium term

Source: Oxford Economics

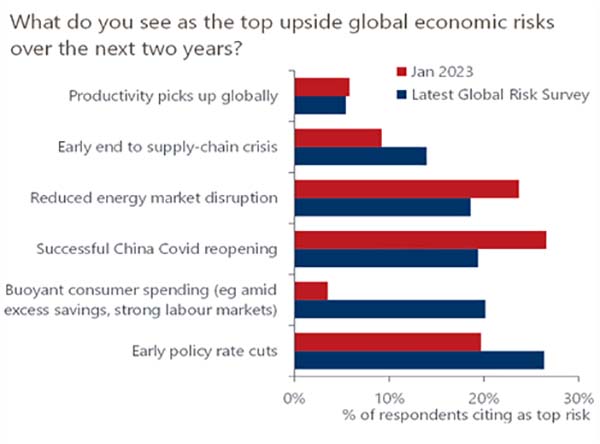

More businesses see consumer spending as key upside

Businesses see various potential sources of stronger growth in the near term. As last quarter, successful China Covid reopening, reduced energy market disruption, and early policy rate cuts lie among the top perceived upside risks over the next two years.

In the latest survey, these upsides are joined by the potential for a stronger consumer-led recovery – for example, supported by the run-down of excess savings accumulated during the pandemic. Around 1-in-5 businesses now see buoyant consumer spending as the top upside risk in the near term (Chart 10).

Chart 10: More businesses see consumer-led recovery as the key potential upside

Source: Oxford Economics

Key themes

Businesses see material risk of financial crisis

This month, we asked businesses about the likelihood of current banking system strains developing into a full-blown financial crisis. As reflected in their responses to other questions in the survey, respondents perceive a material risk.

Businesses on average judge there to be around a 1-in-3 chance of a full-blown financial crisis comparable to the global financial crisis. This broadly matches the incidence of severe financial crises following historical episodes of multiple bank failures (Chart 11).

Chart 11: Businesses see a 1-in-3 chance of full-blown financial crisis

Source: Oxford Economics

*Blue bars show estimated probability of a full-blown financial crisis comparable to the global financial crisis, based on: the incidence in bank failure episodes of GDP impacts at least as large as the median global financial crisis episode; and business perceptions, as reported in our latest Global Risk Survey.

More businesses taking steps to improve supply-chain resilience

Finally, we also asked businesses about their supply chains. Overall, three-fifths of respondents reported that they are taking concrete steps to improve the resilience of their supply chains, up 6ppts on a year ago. The proportion of production affected is significant, 44% on average for these businesses.

As in 2022, the most popular step is geographic diversification of suppliers, a measure taken by almost two-thirds of those businesses improving supply-chain resilience. But more than a third also report pursuing a policy of “friend-shoring” and rerouting supply-chains to allied countries.

Chart 12: More businesses are taking concrete steps to improve supply-chain resilience

Source: Oxford Economics

Article credit: Oxford Economics