The South African Revenue Service (SARS) introduced the new Approval for International Transfer (AIT) process on 24 April 2023, which heralds a significant change in the disclosure requirements for South Africans taking money abroad.

The AIT process applies to both South African tax residents who transfer more than R1 million out of South Africa in a calendar year, as well as for taxpayers who have ceased their tax residency in South Africa. This was described by SARS as to “facilitate the consolidation … into a single application”.

Non-technical advisors’ fear mongering

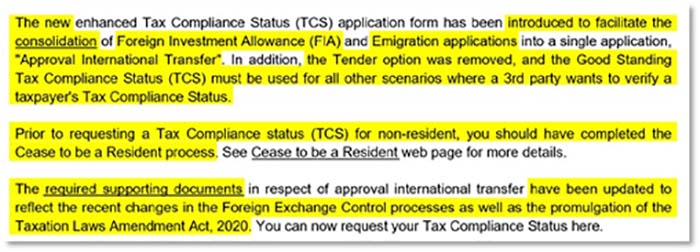

There have been some commentaries claiming that SARS has removed the Foreign Investment Allowance and Emigration / Financial Emigration processes. This is not true. For those who are more technically inclined, SARS has gone on record to educate taxpayers by confirming that this change has been introduced to facilitate the “consolidation” of the previously separate Foreign Investment Allowances and Emigration applications:

SARS probably knew that certain advisors might get this wrong and emphasised that the AIT is simply what is “(previously known as Foreign Investment Allowance and/or Emigration)”. There is not much more SARS could do to make it clear that the requirements of what was previously known as the Foreign Investment Allowance and Emigration are still fully entrenched in getting money abroad.

Industry-wide sessions show tax practitioners initial views on the new process

Following the introduction of the AIT, Tax Consulting South Africa has since been approached by several SARS-recognised professional bodies to provide clarity on these changes through member specialist training. The first session with the South African Institute of Taxation (SAIT), held on 23 May 2023, provided unique insight to the new process, SARS’ strategic intent, and the views of tax professionals.

Throughout the webinar attendees were asked to share their thoughts on the new process and taking into consideration the supporting documentary requirements by SARS.

The views of expressed by tax professionals during the session are as follows:

- 88% agreed that the process has changed significantly; and

- 82% stated that the process is more complex and materially more work.

Lastly, the majority (82%) believe that given the level of detail and risk of criminal sanction, the assistance of a tax practitioner and/or an accountant is essential in this process.

One attendee’s comment echoed this sentiment and stated: “seems like the client must sit next to you when completing this application … the initial request list is going to be very comprehensive.”

Tax Consultants, Accountants and Financial Planners Gearing Up

This in-depth training provided much-needed clarity on SARS’ changes to the TCS process. More importantly, it also highlighted that there is a need for information sharing among professionals in the sector and their clients to ensure a harmonious transition into the new system, where all parties work together to achieve a single goal – the taxpayer’s compliance.

The feedback from the training session with SAIT members was overwhelmingly positive, with many requesting a second webinar for wider staff and industry peers. This session has been set for 3 June 2023 at 10am. There are additional training sessions with other SARS-recognised professional bodies, including the FPI, and SAIPA throughout June 2023.