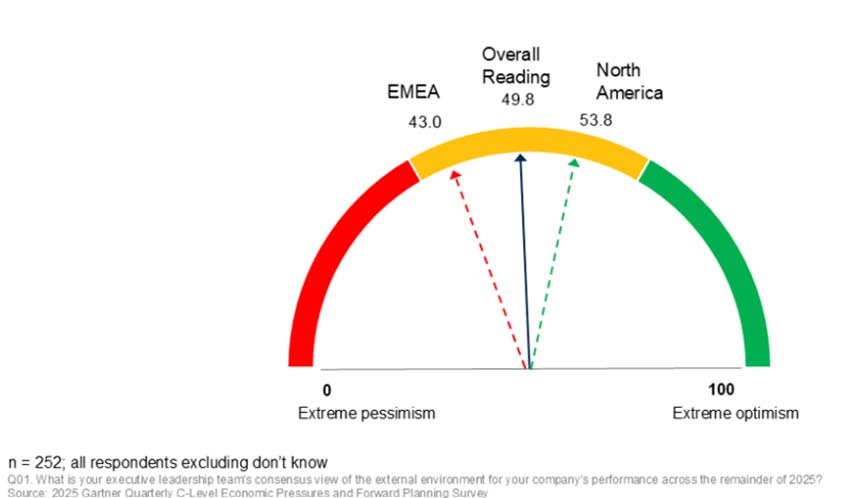

Executive leaders are tempered in their optimism about economic growth and their own organisation’s top-line growth, with the Gartner Executive Confidence Barometer totaling just49.8 out of 100 in the second quarter of 2025.

Chief financial officers (CFOs) have a critical role in helping these executives navigate uncertain economic conditions.

Gartner’s Executive Confidence Barometer is calculated from executives’ rating about the favorability of the current environment for their organizations’ performance (rated on a 1 to 5 favorability scale and then normalized to a 100-point scale).

The survey of 253 cross functional respondents, largely from Europe (n=94) and North America (n=146), showed that European executives were more pessimistic about growth prospects, with a 43.0 confidence reading, than their North American counterparts who had a 53.8 confidence reading (see Figure 1).

“Approximately three quarters of executives are recalibrating their top-line growth expectations down since the start of the year,” says Randeep Rathindran, distinguished vice-president: research in the Gartner Finance practice. “However, a lot of the trends slowing growth – such as tepid demand growth, high input costs and expensive capital – have been present for much longer.”

Gartner’s Executive Confidence Barometer Reading

Source: Gartner (July 2025)

Fifty-nine percent of executives reported reduced demand from existing customers among the top three greatest external risks to their organisation’s growth performance in 2025. They name accelerated inflation (52%) and insufficient organic growth opportunities (50%) among their top performance risks as concerns about constrained supply of inputs and potential foreign market access restrictions take hold.

To address these challenges, Gartners suggests that CFOs adopt a proactive, catalyst-oriented approach, moving beyond traditional cost-cutting and reactive decision-making.

The three key strategies are:

- Redirect spending for differentiation: CFOs should educate executive teams and boards on the realities of the volatile, uncertain, complex and ambiguous (VUCA) economy and shift spending away from commoditized costs toward assets and capabilities that drive true competitive advantage. “CFOs should be looking to invest in scale by focusing on fewer industries, key geographic markets and core products and services that differentiate their organization from competitors, while seeking to avoid unprofitable expansion,” says Rathindran.

- Build a cost-conscious culture: Rather than relying on episodic, finance-driven cost cuts, CFOs must foster a culture of sustained cost efficiency. This involves multimodel budgeting for greater transparency, empowering business leaders to make cost decisions, and implementing incentives that reward cost optimization and reinvestment in growth. “The most successful organizations in difficult economic times do not make unsustainable knee-jerk cost cuts that fail to deliver lasting results,” says Rathindran. “Successful CFOs achieve sustainable cost reduction by continually fostering greater accountability among business leaders through improved budgeting, incentives, and finance partnership.”

- Enable rapid adaptation through scenario planning: To counter decision paralysis, CFOs should integrate scenario planning and tariff modeling into processes, allowing for agile responses to policy changes and external shocks. Engaging with policy partners and conducting location-specific risk assessments will furth strengthen organisational resilience. “Traditional, linear planning is too rigid to be useful in a highly volatile environment,” said Rathindran. “Gaming out various financial scenarios helps organizations to be ready for disruptions and trade restrictions and stay agile in the face of constant change.”