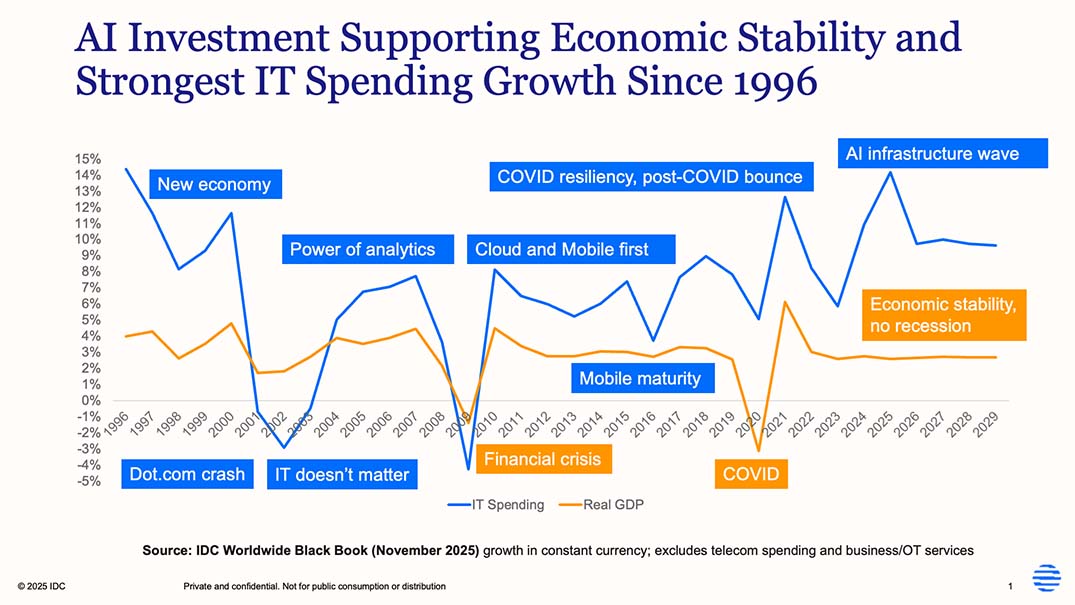

Worldwide spending on IT – including hardware, software and IT services – is on course to post an increase of 14% in 2025, representing the fastest year of growth since 1996 when the launch of Windows 95, expanding PC usage and Internet adoption were the primary drivers of IT spending.

Some 30 years later, the emergence of a massive AI infrastructure investment wave is driving another supercycle of tech spending around the world, with IT spending set to reach $4,25-trillion this year.

Total ICT spending (which includes telecom and business services, in addition to IT spending) will reach almost $7-trillion this year.

In the latest version of IDC’s monthly Worldwide Black Book, which is updated on the last day of every month, this year’s IT spending forecast was increased for a seventh consecutive month in November, reflecting continued over-performance and aggressive investments by service providers in AI infrastructure. T

his month’s forecast increase also reflected strong enterprise software spending, with many organisations continuing with digital transformation and cloud migration projects.

Software spending is now expected to increase by 14% this year, with AI deployments adding to investments in security, optimization and analytics.

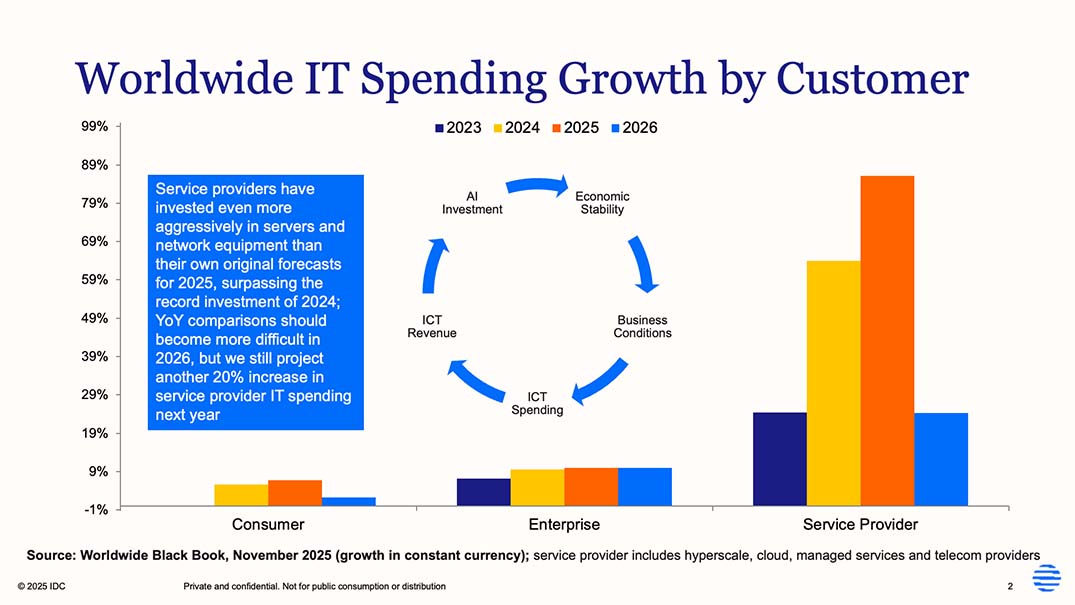

“AI is the headline of IT market performance in 2025, but most of the actual AI investment this year is concentrated in service provider infrastructure,” says Stephen Minton, group vice-president at IDC.

“This AI investment is partly supported by enterprise spending on core IT products and services, which make up the strong revenue streams of the service providers investing heavily in AI deployment.

“In turn, this AI investment is supporting economic growth and stability, which in turn is supporting the ability of businesses to maintain their investments in cloud services and enterprise software.

“As a result, we’re currently experiencing a virtuous cycle of tech-driven macroeconomic growth.”

IT spending increased by 16% in the first quarter or 2025, partly due to front-loading of PC shipments ahead of anticipated tariffs in Q2, and which represented the fastest quarterly IT market growth in 29 years.

While service providers are driving some of this IT market growth, enterprise IT spending increased by 11% in Q1 and 10% in Q2.

Meanwhile, service provider spending on datacentre infrastructure (server/storage and network equipment) is set to post an increase of 86% in 2025, reaching almost half a trillion dollars this year.

While there is much speculation about how and when this cycle may unwind, there is so far no evidence of any slowdown taking hold, and surveys continue to indicate that most businesses plan to increase IT budgets again in 2026, despite lingering anxiety around the overall economy.

IDC forecasts that IT spending will increase by 10% in 2026, slower than 2025 but still representing one of the strongest years for the industry since the 1990s.

“There are headwinds and downside risks in the 2026 outlook, including an expected memory component shortage which may drive up PC prices next year,” says Minton.

“Technology demand has been resilient this year in the face of uncertainty around tariffs and a sluggish global economy, but our baseline forecast calls for a stable economy, supported in part by ongoing AI investment.

“Even in a moderate recession, most IT spending would continue. The likelihood of a ‘perfect storm’ similar to the IT market crash of 2001 remains low.”