They can get to the right questions; and the right spend, writes Allan Dickson, independent chairman at redPanda Software.

“As a retailer, how much should I be spending on IT?”

Although retail decision-makers have been asking this question (with high frequency) for decades, the amplified role of technology in driving sales today has arguably made this question more important than ever before.

Without a doubt, the global retail industry is in a state of flux…but not all retailers realise that it is mutating almost as fast as the variants of Covid-19. Several large international retailers like Walmart, Target and Amazon are doing phenomenally well, whilst others such as the UK’s Debenhams and Arcadia have gone into business administration.

By taking a step back, it’s clear to see that the best retailers are those companies that have an executive team carefully analysing market trends and the needs of their customers – and responding with both flexibility and vision.

Finding the sweet spot

Within many retail businesses, IT is frequently regarded as a cloud of costs hanging over the company – with inadequate visibility provided into cost attribution by project or service.

In my experience, CEOs are rarely entirely comfortable with the explanation given by their CIOs in response to key concerns, such as:

* Their IT spend is so high; and ‘is it adding value?’

* The budget increase requested exceeds their revenue growth; and

* Having learnt about Moore’s Law in Business School, why should they not expect the speed and capability of their computers to increase every couple of years, with reducing cost?

Now, the 2% of revenue mark is still popularly regarded as the retail industry benchmark for measuring their IT spend. If you are below this you are supposedly managing your costs well, but above this marker, the CEO might suggest to the CIO that he/she update their CV before looking for a new role.

The latter situation sometimes leads to a suggestion by the CFO to undertake an ‘objective’ industry benchmark against specific competitors, or against broader-based metrics.

Let’s ditch the outdated benchmarks

Given today’s very different business and operational landscape, benchmarking IT spend as a percentage of revenue in the retail industry makes limited sense.

Why? Done at too high a level, it merely scratches the surface and yields few insights into why costs may be out of kilter. Conversely, done at too low a level, it requires significant data collection efforts and unless done (very expensively) by benchmarking experts, may lead to inaccuracies, lack of relevant comparative data and even ‘fake news’. (For example, not all retailers treat POS costs as part of the IT budget, as opposed to Retails Ops?).

To illustrate this, as the millennium approached, the Edcon group took the decision not to retrofit their existing systems to accommodate Y2K, but rather to replace many of them with Oracle’s (then Retek) ERP. As a result, their IT spend topped the 4% mark – but this was part of a deliberate strategy (and did not contribute in any way to their recent demise).

Understanding the strategic role of IT

Instead of using these types of rigid benchmarks, leaders should rather be looking to better understand the current and future role of technology within the business.

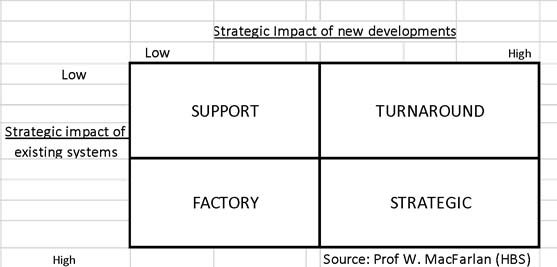

Professor Warren McFarlan of Harvard Business school published his famous Information Systems Strategic Grid many years ago to assist organisations in determining whether or not their IT activities played a strategic role in their business.

The Grid compares the strategic importance of existing operating systems to the strategic impact of planned new systems. Some companies see IT as a necessary evil, spending the minimum amount on basic transaction processing systems (Factory/Support). Others recognise that IT can provide the core systems and opportunities that will drive their business success.

This is a highly useful starting point for discussions with retail executive teams. Objectively assessing themselves on the Grid assists them to determine whether IT is merely supporting their businesses, or if it is core to the delivery of products, services and sustained competitive advantage.

Consumers are leading the innovation

Admittedly, different retail verticals will be at different stages on the Grid…but few have escaped significant volatility and rapid change over the past decade. Much of this has been brought about by consumer adoption of digital technologies, and of course, accelerated by Covid-19. In many ways, the consumers are doing the innovating whilst the retailers are merely responding.

Among retailers, the responses themselves will vary. For example, IT-enabled innovation for some retailers will be around ‘providing a better customer experience’; whilst for others, such as the FMCG merchants with their wafer-thin margins, creating operational efficiencies that affect their bottom-line is key. In some cases, it becomes a combination of both objectives: for example, offering food shopping in a single basket across multiple channels.

For many retailers that have invested heavily over the years into ERP implementations to eliminate technology silos (that became process choke-points), there is the reality that they have not reached the end of their investment cycles.

Greater elasticity is required

Looking ahead, the South African love affair with shopping at brick and mortar locations will not end overnight. This reality has to be balanced with insight into the growing dependence on and popularity of online shopping. Indeed, local retailers will have to ensure that they are making adequate investments into IT and supporting processes in their various channels to meet the more sophisticated demands of their customers.

This may well require them to view their IT budgets with greater elasticity, and vision.