The latest Experian Consumer Default Index (CDI), showed a return to the former trend of long-term deterioration, expedited by the rapid increase in living expenses experienced by South African consumers and exacerbated by the significantly intensified load shedding applied by Eskom during 2023 Q1.

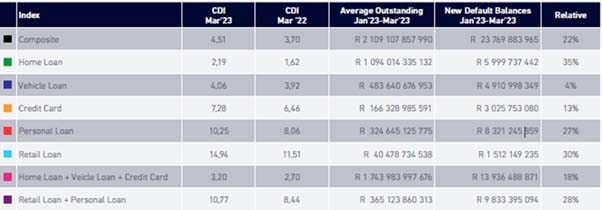

The index tracks the marginal default rate as it measures the sum of first-time defaulted balances within the Home Loan, Vehicle Loan, Personal Loan, Credit Card and Retail Loan portfolios. These are accounts that have never previously defaulted, as a percentage of the total sum of balances outstanding.

The CDI exhibited a quarter-on-quarter (Q-o-Q) deterioration from 3.93 in December 2022 to 4.51 in January 2023.

“A significant deterioration for the latest reporting period was already pre-empted in 2022 Q4 when we saw an earlier-than-usual deterioration in CDI, considering the typical annual cycle of the CDI. It would seem that the CDI has not only fully returned to the long-term deteriorating trend observed pre-Covid, but that the deterioration is happening at a faster pace,” says Jaco van Jaarsveldt, head of commercial strategy and innovation at Experian Africa.

Year-on-year (Y-o-Y), composite CDI deteriorated from 3.70 to 4.51 – a relative deterioration of no less than 22%. Furthermore, all the product-specific CDI metrics also deteriorated Y-o-Y. Most notable of these was the Home Loans portfolio deteriorating from 1.62 to 2.19 (35%). The Retail portfolio was not far behind in relative terms, showing a 30% deterioration (from 11.51 to 14.94).

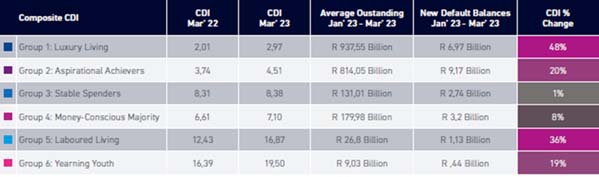

Consumer default performance by Financial Affluent Segments (FAS)

2023 Q1 showed that rapid deterioration in CDI terms was observed on the two extreme ends of the consumer landscape – the most affluent and the least affluent consumers. Indeed, the biggest relative deterioration was seen for FAS Group 1 (Luxury Living).

Although these consumers are typically of the highest affluence (and generally represent the lowest credit risk), their CDI has been under severe pressure – particularly since the pandemic. “We also note that these consumers typically not only continued to qualify for new or more credit throughout the pandemic but have also become increasingly dependent on credit to fund their standard of living,” adds van Jaarsveldt.

On the other hand, the mid-affluence FAS Groups 3 (Stable Spender) and 4 (Money conscious), consumers of typically mid-range affluence, generally showed minor Y-o-Y change in Composite CDI.

The less affluent FAS Group 5 showed the second-most significant deterioration in Composite CDI – worsening by 36% Y-o-Y. These consumers have been taking up more unsecured credit since 2021 Q4 and are quickly returning to the high levels of CDI that were seen pre-pandemic.

Debt Review

The total number of Debt Review applications has seen a marked increase over the last two years.

From a FAS perspective, the relative increase in representation of high affluence consumers is quite striking – specifically with regard to FAS Group 2 (Aspirational Achievers).

These are typically younger consumers, who are less likely to successfully navigate their financial way through the interest rate upcycles they are experiencing for the first time.

Cost of living remains on an upward trend

Market appetite for credit increased even further, as consumers look to credit to bridge the gap in covering living expenses.

Not only does the Consumer Price Inflation, driven by fuel cost increases and food price hikes, remain at very high levels and outside the SARB’s target band, but the cost of living, which remains on an upward trend, has likely decreased consumers’ affordability and impacted on their ability to meet debt obligations.

“All South Africans need to establish strong financial practices to get through the challenging economic environment we are facing. It is vital that consumers stay on top of their credit health, carefully monitor how they use credit and maintain accurate household budgets,” says van Jaarsveldt.