South African consumers spent R112-billion in the first quarter of 2024 – a YoY increase of R7,7-billion (7,3%) – with ambient foods (including rice, sugar, and UHT milk), soft drinks, beer and frozen meat among the most significant contributors to this growth.

This is according to NIQ South Africa’s latest State of the Retail Nation analysis for the quarter which adds that modern trade within South Africa’s fast-moving consumer goods (FMCG) sector is worth around R452-billion a year and is growing at around 8,8% a year.

Growth in the total FMCG basket is largely driven by consumers adding more items to their basket at higher unit prices. On average, consumers visit the shops four times a month, spending R542 per trip compared to more than six visits per month five years ago.

Consumers developing new habits and becoming more calculated

“With CPI and food inflation moderating in recent months, consumers may start to regain some lost ground in purchasing power,” says Zak Haeri, MD of NIQ in South Africa. “Nonetheless, many South Africans are under pressure with 44% of consumers feeling that they are financially worse off than a year ago, prompting nearly all to change their FMCG shopping habits to save money.

“Factors such as transport costs, cost of utilities and unemployment rates are still constraining consumer spending,” he adds. “Our data shows that private labels are gaining market share and growing faster than major brands as consumers try to stretch their rands further.”

Another trend shows consumers concentrating more of their spending with fewer retailers to maximise loyalty rewards. Additionally, they are opting to travel to stores in the most convenient locations, preferably those closest to home, to save on fuel costs.

Manufacturers and retailers to cut back promotions to protect margins

The volume of goods sold on promotion (31%) has risen in recent years, however, NIQ forecasts that this will drop in 2024 and into 2025 as retailers and manufacturers seek to protect profits – putting more pressure on consumers’ pockets. NIQ data shows that buying whatever brand is on promotion is a preferred saving strategy for 39% of consumers.

The concentrated nature of South Africa’s FMCG market means that manufacturers have significant pricing power. The top 10 manufacturers contribute more than 50% of branded goods sales compared to 30% to 40% in Europe. The top 10% of Stock Keeping Units (SKUs) contribute to 80% of the value of sales in South Africa.

“Large manufacturers benefit from economies of scale allowing them to produce goods more efficiently and at a lower cost,” says Haeri. “At the same time, a highly concentrated market means consumers have fewer choices and manufacturers have more ability to protect their margins than in more competitive markets.”

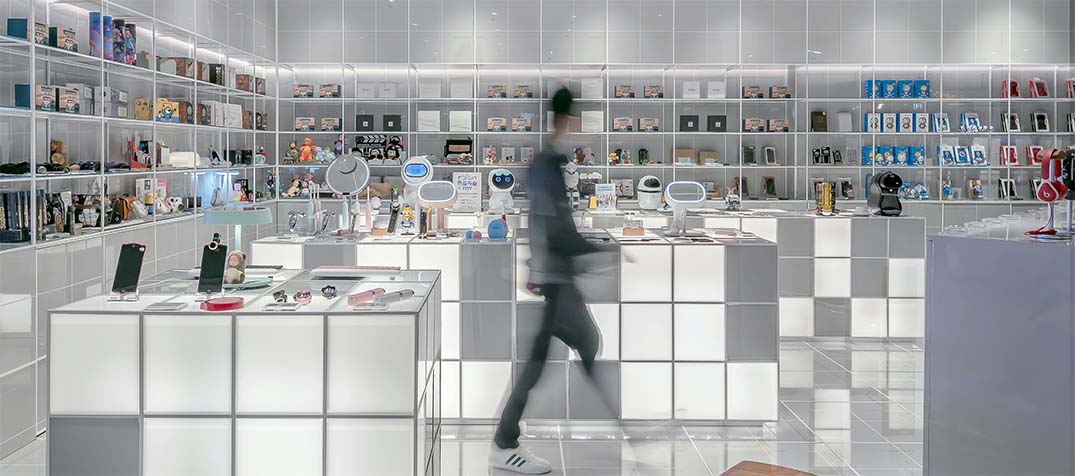

Value for money brands disrupt tech and durables sector amid flat growth

The Technology & Durables market, meanwhile, was relatively flat in the first quarter of the year expanding by just 2%. The long-term trend of sales in the consumer technical goods market moving online continued to unfold.

The coffee machine segment was a top performer, recording 16,1% growth YoY. One particular brand grew revenues by 39,1%, market share by 3,9% and unit growth by 32,5% which indicates that it was able to successfully sell its products at higher price points.

“Consumers decided that there was no better way to address whatever developing crises 2024 held – energy, water, cost of living, elections – than with a coffee,” says Haeri.

“The slow pace of growth in the technology and durables market disguises the dynamism we are seeing in the tech and durables market,” he adds. “Disruption is the theme of the year, with fierce competition and rapid changes observed across most product categories as consumers explore alternate brands to find the best value for money. Emerging brands are the big winners, with consumers increasingly questioning whether established brands are worth the premium in pricing.”

This trend is especially evident in the smartphone market which experienced flat unit growth for the quarter. However, Chinese brands in this product category grew unit sales by 93,6%.

“Government policy to discontinue 3G bandwidth is driving change in this market,” says Haeri. “But innovation is attracting pre-paid and post-paid consumers alike to seek better value. It’s not just entry-level and mid-market consumers that are embracing Chinese consumer brands – it’s premium customers too.”

Reasons customers are switching to emerging brands include offering a wider product choice within the 5G market, the inclusion of additional accessories in the box, and access to better features and technology at a lower price point.

“With consumers being more cautious and demanding with their spending they are becoming more open to alternatives offering better value,” says Haeri.