As South Africa commemorates Youth Day, the spotlight falls on the financial health of young consumers and their ability to leverage credit as a tool for empowerment.

Experian’s Consumer Default Index (CDIx) for Q1 2024 reveals a complex picture for young South Africans, highlighting the need for both increased access to responsible credit and enhanced financial literacy.

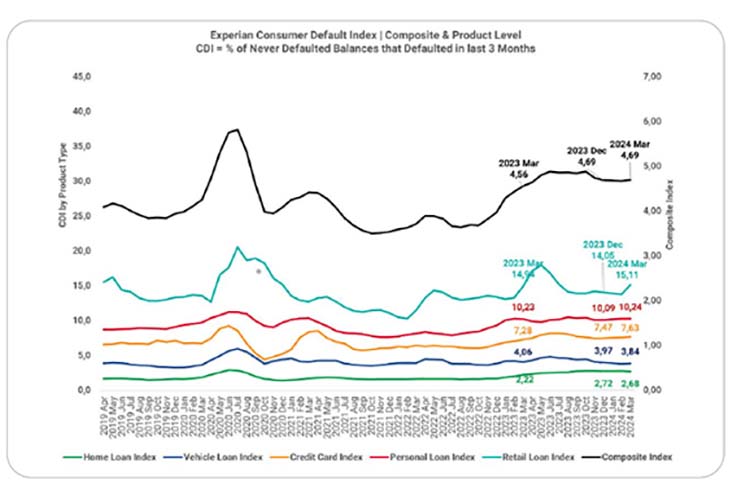

The Index measures the rolling default behaviour of South African consumers with Home Loan, Vehicle Loan, Personal Loan, Credit Card, and Retail Loan accounts.

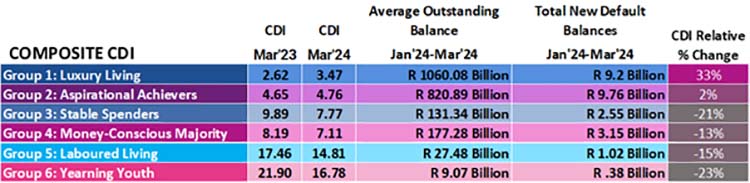

The CDI for the youngest consumer group – the Yearning Youth – as measured by Experian’s Financial Affluence Segmentation (FAS), dropped significantly from 21.9 in March 2023 to 16.8 in March 2024.

However, this positive trend doesn’t necessarily mean their finances have drastically improved. It’s rather a case of them finding it harder to access new loans than before the pandemic, as the supply of credit in this category has not returned to pre-pandemic levels.

“This consumer segment, representing 16.4% of credit-active South Africans, is traditionally highly exposed to unsecured credit, with over 80% of the Yearning Youth being active in the retail credit market,” says Jaco van Jaarsveldt, Experian’s head of commercial strategy and innovation.

“We have, however, seen a slowdown in credit extension to these young and credit inexperienced consumers so that while fewer defaults are good, limited access to credit can hinder their financial progress. This highlights the need for increased financial literacy and responsible credit options for young South Africans,”

Considering all consumer segments, the Composite CDI has remained relatively stable from December 2023 to March 2024. However, when this year’s data is compared to last year’s, the CDI continued to show deterioration, moving from 4.56 to 4.69.

“In simpler terms, more people are struggling to repay their loans compared to last year. However, considering the index has remained flat quarter-on-quarter, this indicates that although consumers still find it challenging to honour debt commitments, the situation is not worsening at the same speed observed in 2023,” adds van Jaarsveldt.

At a product level, Home Loans saw the largest deterioration in CDI, with a 21% deterioration Y-o-Y up from 2.22 to 2.68. Although still significant, the rate of deterioration is slowing down, considering that in Q4 2023, we saw an annual deterioration rate of 60%. With Home Loans accounting for the majority share of the total market exposure, the deterioration in Home Loans was the main driver of the deterioration seen in the composite CDI.

Credit Cards was the other (albeit less significant) driver of the deterioration in composite CDI, moving from 7.28 to 7.63 Y-o-Y, a 5% deterioration. This suggests that mid-to-high affluence consumers – who typically qualify for these high-end credit products – continue to find it difficult to repay debt and are, in fact, becoming more dependent on their credit cards to cover monthly expenses.

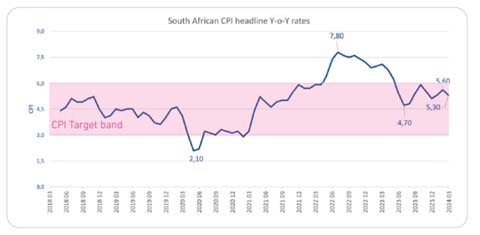

Despite the Consumer Price Inflation (CPI) remaining within the South African Reserve Bank’s target band of 3% to 6%, the cost of living continues to increase, putting pressure on consumers.

“The rapid rate at which interest rates have increased and have now been at a sustained high level for the last 12 months has put immense strain on credit-active consumers, particularly those exposed to secured credit,” explains van Jaarsveldt.

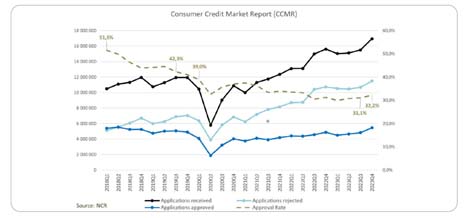

The report also highlights a strong market appetite for consumer credit, with application levels reaching record highs in Q4 2023. However, approval levels remain low at 32.2%, suggesting that more than two-thirds of applications are rejected – partly due to consumers’ inability to afford additional credit commitments.

The report also highlights a strong market appetite for consumer credit, with application levels reaching record highs in Q4 2023. However, approval levels remain low at 32.2%, suggesting that more than two-thirds of applications are rejected – partly due to consumers’ inability to afford additional credit commitments.

Experian’s Up app provides a valuable solution, offering a user-friendly platform for managing financial wellness. Through gamified education, budgeting tools, and credit score tracking, the platform empowers consumers to make informed decisions and build a solid foundation for their financial future.

Experian’s Up app provides a valuable solution, offering a user-friendly platform for managing financial wellness. Through gamified education, budgeting tools, and credit score tracking, the platform empowers consumers to make informed decisions and build a solid foundation for their financial future.

“By understanding their credit reports and scores, young South Africans can take proactive steps to improve their creditworthiness, access responsible credit options, and ultimately unlock their full financial potential,” concludes van Jaarsveldt.