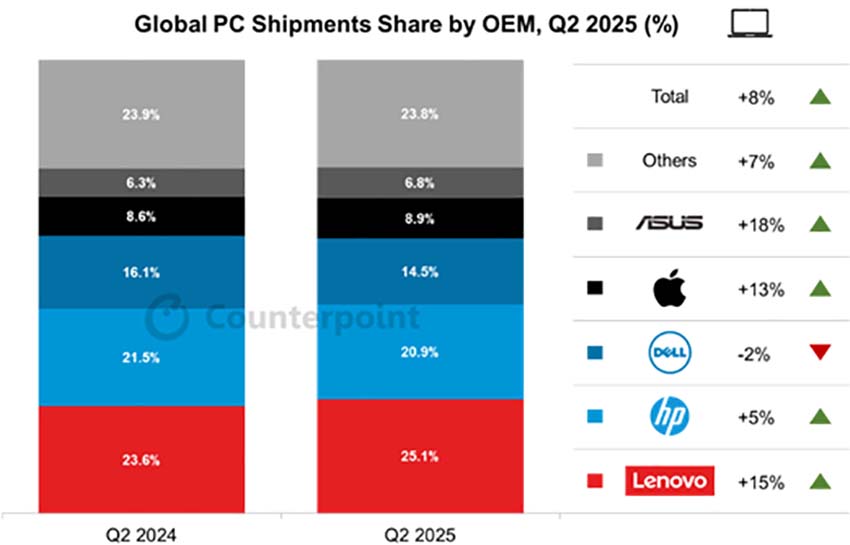

Counterpoint Research’s preliminary estimates from its PC service indicate that the global PC shipment market grew 8,4% YoY in Q2 2025, marking the highest YoY increase since 2022 when pandemic-driven demand lifted the market.

The Q2 growth was mainly driven by the approaching Windows 10 sunset, the early adoption of AI PCs, and stronger commercial demand caused by a pull-in during early in the quarter as the market prepared for a tariff and inventory buildup in anticipation of the upcoming back-to-school demand.

Due to uncertainty related to the US tariff policy, many OEMs are currently in a “wait-and-see” mode, and OEMs are adjusting their manufacturing locations as tariff concerns continue to loom. These restrictions and supply chain reallocations are expected to be a hurdle for PC shipments in 2025.

Growth during the quarter was driven by the commercial segment, as large enterprises and public institutions accelerated device upgrades ahead of the Windows 10 support deadline in late 2025.

Meanwhile, the consumer segment showed mixed signals, with moderate growth in mid-range laptops partly offset by weaker-than-expected demand for premium ultrathin models in mature markets.

Source: Counterpoint’s preliminary data

During the quarter, Lenovo maintained its leadership position, accounting for roughly 25% of total shipments, which was driven by the combined effects of pre-tariff inventory adjustments, the Windows 10 replacement cycle, and initial demand for AI PCs.

HP and Dell followed in ranking, with both brands reporting stable enterprise demand but facing pressure from smaller OEMs’ aggressive pricing. Apple continued to see solid MacBook sales, supported by the refreshed M4 series models, although its shipment growth was more subdued than in previous quarters.

Commenting on the future of global PC shipments, senior analyst Minsoo Kang notes: “Due to the US tariff-related uncertainty, PC shipments will likely weaken YoY starting from H2 2025. However, demand for AI PCs is expected to become a significant tailwind in 2026. We expect more than half of the laptops shipped in 2026 onward to be an AI laptop.”

The global PC manufacturing sector remains heavily concentrated in China, which continues to pose significant challenges for the industry, particularly in managing tariff-related risks. Although recent developments in US trade policy, such as the temporary removal of tariffs on laptops, have provided some relief, uncertainties persist.

Furthermore, the looming possibility of new duties on semiconductor components and other technology products, as announced by the US government, is expected to take effect in the coming months, raising further concerns for the industry.

In response to this changing geopolitical landscape, PC vendors and their manufacturing partners, particularly original design manufacturers (ODMs) and electronics manufacturing services (EMS) providers, have intensified efforts to shift production capacity away from China.

Countries like Vietnam, India, and Mexico have emerged as alternative manufacturing hubs, despite these locations also facing unique challenges, such as varying tariff structures and infrastructure constraints. The ongoing diversification of production bases reflects an industry-wide strategy to minimize exposure to trade disruptions while ensuring supply chain resilience.

Commenting on how the current macroeconomic situation will likely affect the global PC market, associate director David Naranjo says: “The US market remains the most important market for AI PCs to demonstrate their capabilities and the best market to sell advanced AI-enabled PCs. The tariff policy roller coaster will likely cause consumers and enterprises to pause their AI PC purchases in 2025, which in turn will suppress growth for this segment. The lingering global economic uncertainty also poses a downside risk to our 2025 PC shipment forecast of low-single-digit YoY percentage growth.”

For PC vendors, ensuring a reliable and cost-effective supply chain for products destined for the US market has become a top priority. A key focus is on transitioning manufacturing for US-bound goods to facilities located outside China.

This strategic realignment is not solely driven by tariff avoidance; it also reflects a broader need to mitigate risks associated with an over-reliance on a single country for critical manufacturing operations.

While this shift is a long-term process requiring significant investments in factory infrastructure, workforce training, and logistics, the trend underscores important transformations in the global PC manufacturing landscape. Leveraging regional hubs outside of China will not only reduce exposure to potential trade disruptions but also allow companies to tap into emerging markets and align with evolving geopolitical realities.

In conclusion, as tariff and trade uncertainties linger, the global PC industry continues to focus on diversifying its production footprint to ensure stability and adaptability. By proactively addressing these challenges, manufacturers and vendors are strategically positioning themselves to navigate the complex dynamics of the global supply chain and strengthen their competitiveness in a rapidly changing environment.

With AI laptops projected to become a mainstream standard by 2026, vendors who invest early in competitive pricing and ecosystem readiness will likely gain an edge in the next wave of PC upgrades.