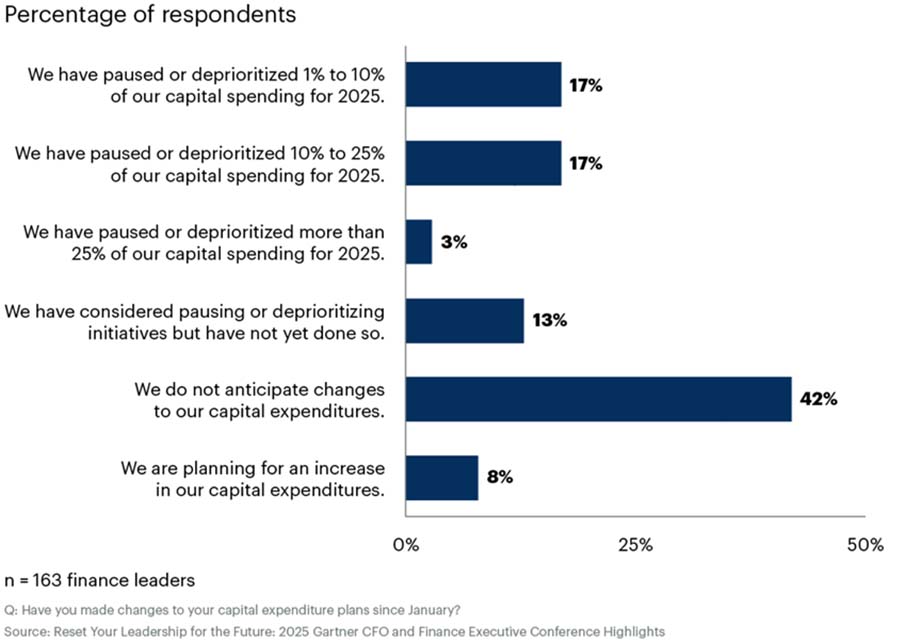

Chief financial officers (CFOs) are entering the second half of 2025 facing a mix of cost pressures, policy shifts and geopolitical risks, resulting in 37% of finance leaders already pausing some capital spending, according to a survey by Gartner.

“This survey of finance leaders shows a near absence of planned increases in capital expenditures in the second half of 2025,” says Alexander Bant, chief of research in the Gartner Finance practice. “This underscores a conservative approach to the uncertain economic and policy landscape organisations are facing currently.”

A Gartner webinar poll of 197 finance leaders, taken on June 19, 2025, revealed a strong inclination toward caution and a willingness to pause or deprioritize capital spending. Three percent of respondents report pausing or deprioritizing more than 25% of capital spending for 2025.

Planned Capital Expenditure Changes in H2 2025

Source: Gartner (July 2025)

“Finance leaders are tightening control over capital outlays until they have clarity on inflation and the federal, tax policy and geopolitical risks,” says Bant. “Since this data was collected the US passed its spending and tax bill budget, giving finance leaders clarity on depreciation schedules, R&D expensing, and other related policy shifts, so they will be better able to forecast capital outlays.

“Some finance leaders could shift toward more capital spending, but interest rates, inflation, and trade policy still cast a great deal of uncertainty in the current moment.”

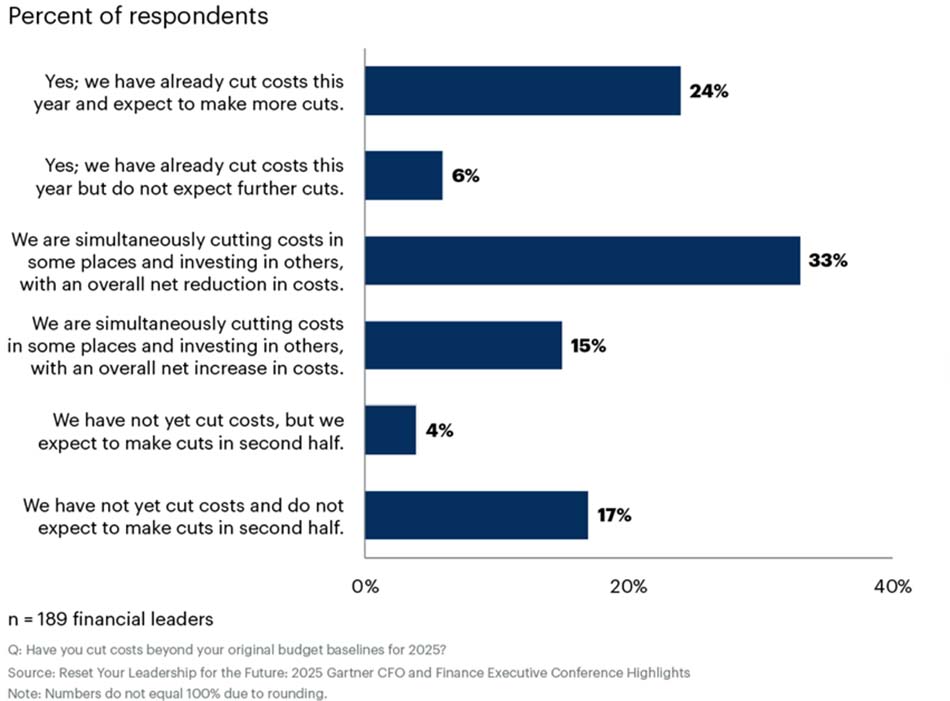

Further, 67% of finance leaders are either currently cutting costs with more expected, have completed cuts or are planning to cut in the second half of the year.

Planned H2 2025 Cost Cuts

Source: Gartner (July 2025)

AI Investment Remains a Top Priority

“It is interesting to note that the largest segment – 33% of respondents – indicates that they are ‘simultaneously cutting costs in some places and investing in others, with an overall net reduction in costs,’” says Bant.

“Companies know the that the time is now to make the right pivots in their cost structure to win the AI race that is heating up. The economic pressure is creating an opportunity to adopt a ‘nothing is sacred mindset’ and make bold reallocation to growth investment and tech purchases that set organization up for an AI future.”

Cuts seem to be aimed towards low ROI software, nonessential travel and external contractors, while protecting investments in internal automation, cybersecurity and financial system modernization.

“We are seeing that even as CFOs tighten cost controls and pause on large-scale investments, they’re not retreating from AI. Instead, they’re sharpening their focus — shifting from broad experimentation to targeted enterprise use cases that offer measurable impact,” says Bant.