Leading banks are reshaping their operations to deliver sustainable growth and cost efficiency.

This is according to a new KPMG report, “Banking Transformation: The New Agenda”. Drawing on a global survey of 228 banking leaders, it outlines practical strategies for African banks to navigate growing economic pressures, regulatory change, and intensifying competition from fintech and digital-first challengers.

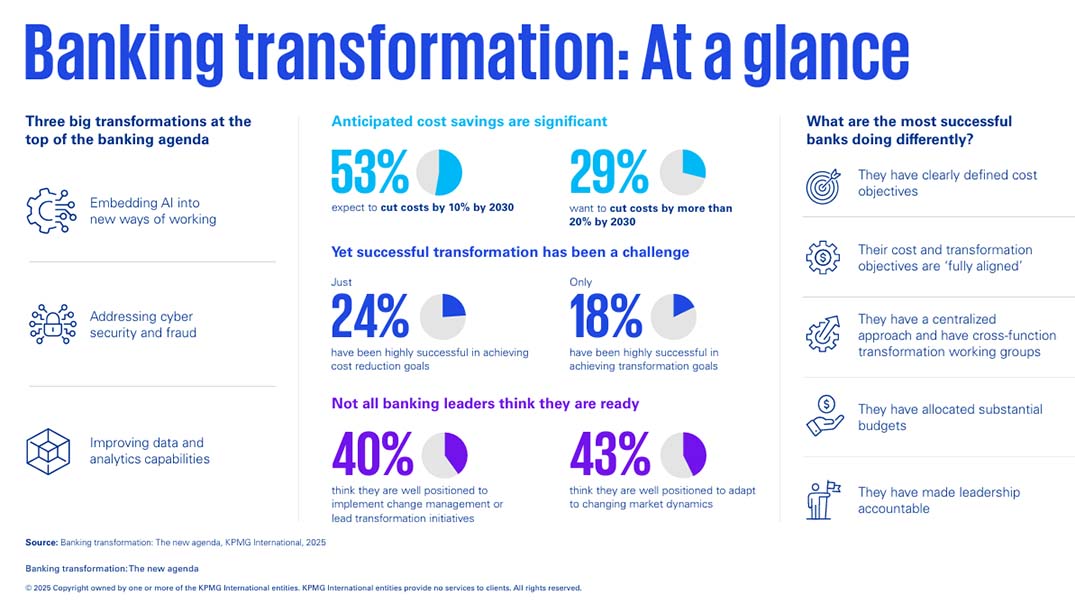

The report shows that, while transformation is a universal imperative, only 18% of banks globally have been highly successful in achieving their transformation objectives.

In addition, 53% of banks aim to cut costs by at least 10% by 2030, yet only 24% have so far met their cost reduction targets.

With just 40% of banks feeling well-positioned to drive transformation effectively, there is a clear need for greater strategic alignment and leadership accountability.

Auguste Claude-Nguetsop

Auguste Claude-Nguetsop, partner and head of financial services sector: advisory for KPMG in southern Africa, says this presents both a challenge and an opportunity for African banks.

“The African banking sector is at a pivotal moment. Banks are under increasing pressure to manage costs, embrace innovation, and deliver better customer experiences, all while navigating economic volatility and regulatory demands. This report provides a roadmap to achieve transformation that goes beyond cost-cutting – it is about building smarter, leaner, and more resilient institutions that can thrive in a fast-evolving financial landscape.”

The report identifies five critical success factors for banks pursuing operational and cost transformation:

- Define clear objectives – knowing who the bank serves, how to serve them, and the products and services that matter most.

- Ensure alignment – integrating cost and transformation objectives so they reinforce each other rather than compete.

- Understand value levers – recognising that while technology is essential, other areas can also unlock value.

- Drive enterprise-wide execution – maintaining visibility, accountability, and leadership across all transformation programmes.

- Leverage experienced partners – drawing on external expertise to accelerate change, especially when deploying advanced technologies like artificial intelligence (AI) and automation.

Kabir Okuniola, partner and head of financial services industry audit at KPMG Nigeria, says many African banks are already taking steps in the right direction but must ensure their efforts are sustainable.

“Numerous transformation initiatives prioritise end-to-end process optimisation through digitalisation, automation, and cost reduction. Banks must consistently focus on the critical link between operational transformation and cost efficiency to drive sustainable progress and deliver value for customers and shareholders.”

Joseph Kariuki, partner and head of banking sector at KPMG East Africa, adds that strong governance and leadership are essential to navigating the complexities of transformation:

“Banks with clear strategies and centralised governance structures tend to see significantly better results. Full alignment of cost and transformation goals is crucial, particularly when assessing hybrid approaches that combine digital innovation with traditional banking models.”

The report highlights that African banks have distinct advantages as they reshape their operating models, including the ability to leapfrog legacy infrastructure through mobile-first solutions and fintech partnerships.

However, the region also faces challenges such as balancing innovation with financial inclusion, infrastructure gaps, and the need for rapid skills development.

Claude-Nguetsop explains: “Africa has a dynamic and fast-growing financial ecosystem. By aligning cost strategies with transformation objectives, banks can unlock efficiencies while driving inclusive growth and digital adoption. This is the moment for African banks to build models that are both resilient and future ready.”