The Chartered Institute for Procurement & Supply (CIPS) Southern Africa has called on South African business leaders to heed the findings of a new report detailing the challenges faced by procurement professionals operating in the maintenance, repair and operations (MRO) space.

The 2025 Indirect Procurement Report, undertaken by global industrial and electronics stockist RS Components in partnership with CIPS, surveyed 426 procurement professionals in the UK and Ireland.

The report outlines challenges such as inflation, supply chain risk, ESG (environmental, sustainability and governance) demands, and skills shortages – all of which mirror the South African context, according to Paul Vos, regional MD of CIPS Southern Africa.

The findings from this year’s report resonate strongly with the realities on the ground in South Africa, Vos says.

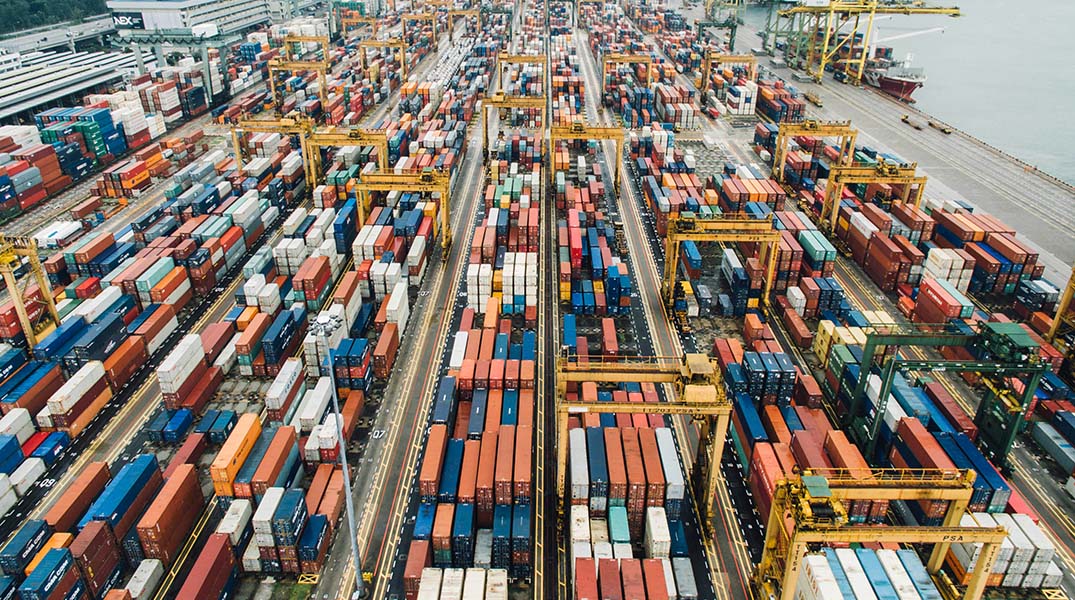

“Procurement professionals here are contending with persistent rand volatility, high energy costs, logistics disruptions at ports, and a chronic shortage of skilled talent,” Vos says. “These challenges demand a far more strategic, digital, and resilient approach to indirect procurement.”

According to the South African Association of Freight Forwarders, the country is losing an estimated R1-billion a day in missed trade opportunities stemming from port delays, rail disruptions, and related infrastructure bottlenecks, among other factors.

The fact that 62% of respondents in the Indirect Procurement Report cited inflation and higher costs as the top business challenge will not be lost on South Africans, Vos adds.

However, he advises local procurement teams to move beyond cost-cutting and embrace value-based sourcing. With imported inflation, and infrastructure constraints like those at Transnet, local supplier development and smarter contract renegotiation are essential tools for survival.

The report also found that 64% of organisations now treat ESG as core to their business strategy. It follows that South African companies will now face rising pressure to demonstrate compliance – particularly around Scope 3 emissions (indirect greenhouse gas (GHG) emissions that occur in an organisation’s value chain) and sustainable procurement.

“South African organisations can’t afford to fall behind global ESG standards,” Vos says. “Investors, regulators, and international customers are demanding transparency. Yet with our fragmented supplier base, building robust ESG auditing and requalification processes will be a heavy lift.”

The report further reveals that nearly 60% of firms lack visibility into order processing costs – and adoption of digital procurement tools remains low. This, too, mirrors what is happening in South Africa.

Vos says too many local procurement teams still operate with manual or outdated systems. Without digital tools like eProcurement and spend analytics, businesses are “flying blind”.

“It’s time to invest in platforms that enable realtime visibility, efficiency, and better supplier performance tracking,” he says.

Vos also points to a disturbing trend in South Africa where businesses are maintaining – rather than replacing – ageing infrastructure due to capital constraints.

He describes this as a “high-stakes issue” in sectors like mining, manufacturing, and utilities and says procurement professionals must work more closely with engineering and maintenance teams to manage the increased risk of breakdowns and ensure continuity of operations.

Vos says the report’s findings highlight the need for a shift in South Africa’s procurement mindset “from transactional to strategic; from reactive to proactive.”

“Stronger supplier relationship management, digital transformation, ESG integration, and professionalisation of the procurement function are no longer optional – they are the backbone of business resilience,” he says.