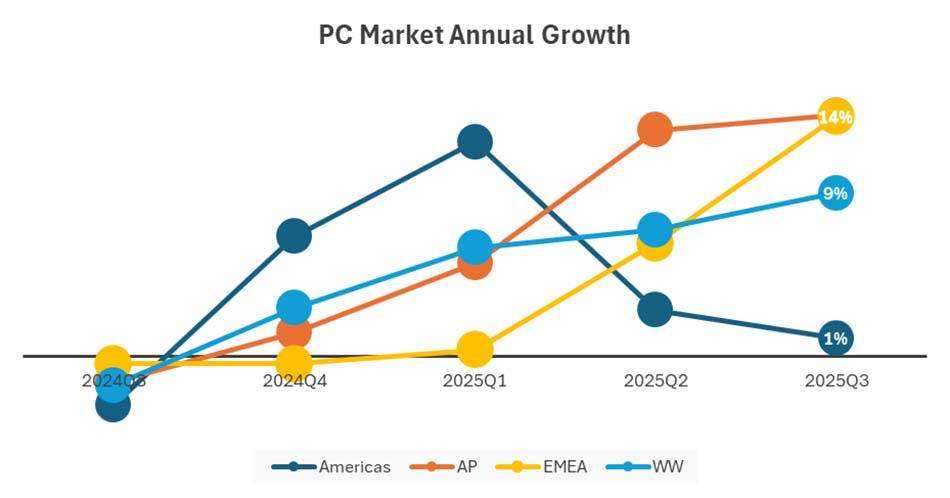

PC shipments during the third quarter of 2025 grew 9,4% from the prior year, with global volumes reaching 75,8-million units, according to preliminary results from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

“While the entire market is continuing on a very strong year, fueled by Windows 11 transition and the need to replace an ageing installed base, the results by regions are telling different stories,” says Jean Philippe Bouchard, research vice-president with IDC’s Worldwide Mobile Device Trackers.

“In particular, the North American market continues to be impacted by the US import tariffs shock and by macroeconomic uncertainties. While existent, the demand for newer PCs ready for Windows 11 is likely to push well into 2026.”

The Asia/Pacific (including Japan and China) PC market recorded double-digit growth.

“The demand was driven largely by Japan’s hardware refresh linked to Windows 10 end-of-support and the GIGA education project,” says Maciek Gornicki, senior research manager with IDC’s Worldwide Device Trackers.

“Growth outside Japan was more modest — hindered by macroeconomic and political challenges and slow Windows 11 adoption — though there were pockets of opportunity from hardware refreshes of devices purchased during and before the Covid-19 pandemic.”

| Top 5 Companies, Worldwide Traditional PC Shipments, Market Share, and Year-Over-Year Growth, Q3 2025 (Preliminary results, shipments are in millions of units) | |||||

| Company | 3Q25 Shipments | 3Q25 Market Share | 3Q24 Shipments | 3Q24 Market Share | 3Q25/3Q24 Growth |

| 1. Lenovo | 19.4 | 25.5% | 16.5 | 23.8% | 17.3% |

| 2. HP Inc | 15.0 | 19.8% | 13.6 | 19.6% | 10.7% |

| 3. Dell Technologies | 10.1 | 13.3% | 9.8 | 14.2% | 2.6% |

| 4. Apple | 6.8 | 9.0% | 6.0 | 8.7% | 13.7% |

| 5. ASUS | 5.9 | 7.8% | 5.3 | 7.7% | 11.4% |

| Others | 18.6 | 24.5% | 18.1 | 26.1% | 3.0% |

| Total | 75.9 | 100.0% | 69.3 | 100.0% | 9.4% |

| Source: IDC Quarterly Personal Computing Device Tracker, October 8, 2025 | |||||